Running a small business is no easy task. Business owners not only have to manage regular business activities and operations during the day, but also need to manage all administrative tasks after business hours. Productivity is king. With the help of technology, business owners can manage expenses, finance and taxes easier than ever. This guide is created by the Foreceipt to help small business owners, self-employed workers and professionals to save time in managing receipts, expenses and taxes more efficiently.

Why do small businesses and self-employed workers need to manage expenses properly?

If you run a small business, it is very likely that you have many transactions keep track of on a daily basis. You might run a flower shop, a restaurant, or a TikTok store. There are cash payments, online payments, employee reimbursements, maintenance costs, supplies and countless other aspects that funds are put towards.

If you’re a freelancer or typically work on your own, in a lot of ways, you are a small business. You probably like having everything in one place. Sure, there may not be as many transactions, but you’ve got a lot of expenses to track: Your desktop or laptop computer, various payment methods from different clients that could range from e-transfers to direct deposits, and most importantly, taxes.

While it might seem annoying to spend extra time in your already-busy day to track expenses and receipts, there are many important reasons why you should spend energy in organizing your expenses regularly. Here are a few most important reasons:

1. Paint a clear picture of your company financial status

Think of every receipt as footprints from your business. While a single receipt may not paint much of a picture, together they encompass an elaborate history of all your expenses and decision making.Information provided by your bank or credit card vendor is limited. You will need itemized receipts to closely track where your budgets are being delegated to. You can’t save money if you don’t know where every penny is going.

2. Be Prepared for Audits

According to the Canada Revenue Agency, they deliciate 54% of their tax compliance budget to small to medium size businesses. If you file taxes in the U.S., there is a 2.5% chance that your small business will be audited by the IRS. If you make any mistakes or claim government assistance during the COVID period, there is an increased chance that your will be audited.

Think about what would happen if your business was being audited. The process becomes a lot less stressful if you’ve taken all of the right precautions in ensuring full transparency with any government agencies. Compare that with a scenario in which you have to scramble and delegate time and resources to tracking expenses that could have happened several months if not a year ago.

3. Tax Deductions = Business Expansion

The benefits of tracking business expenses go beyond your personal advantage. They also help in your business tax deductions. Every receipt tracked is a few dollars saved on your tax returns. On average, people who manage expenses save more than $1000 on tax deductions. The upside to that is obvious. The more of your own income you get to save, the more you can invest back into your business.

4. The Bigger the Team, the Messier the Expenses

As your business expands, it would be natural to add new team members to support growing operations. While they may bring added value to your business, it comes with its own logistical nightmare : every new team member adds an extra source of expense to worry about.

Take our own team at Foreceipt as an example : since the shift to work-from-home in 2020, we’ve added at least 3 part-time staff working in separate remote locations, each dealing with their own area, recording their work expenses and submitting them to our central expense account. Without a system to properly account for new employees, our expansion would have been greatly dampened just by administrative work!

Digitize All Expenses

Use technology to your advantage. At the end of the day, the newest and most innovative technology stands undefeated in comparison to the ways of old. Time is money, and the efficiency alone of modern expense tracking apps saves you an invaluable amount.

Foreceipt turns your paper receipts into digital expense records

Foreceipt has set the standard when it comes to expense management. Letting you scan your receipts with your own smartphone device, it’s the perfect app for those who run a small business or independent venture.

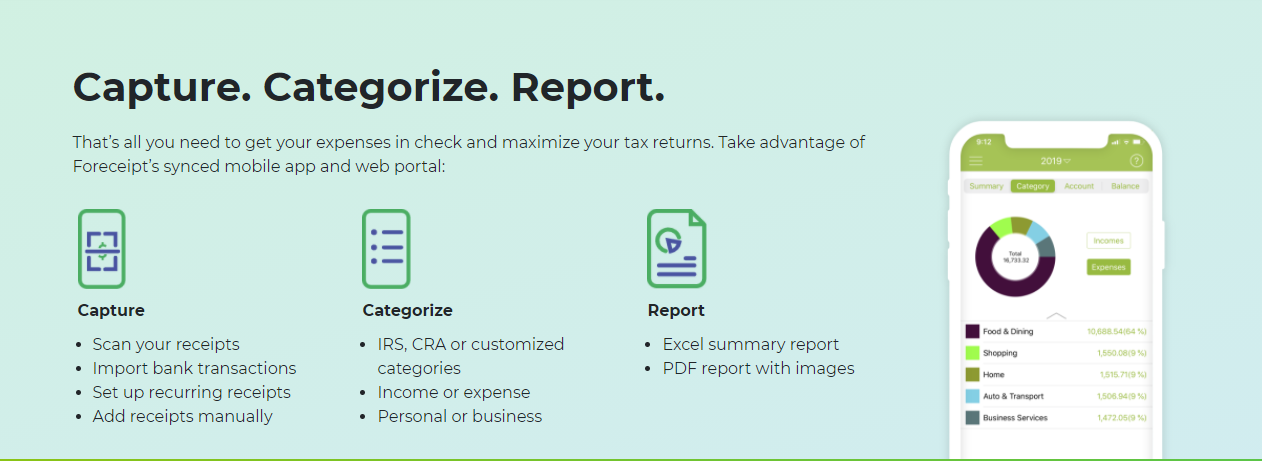

Foreceipt has set a three-step best practices for small business owners to digitize and centralize all expenses into one database.

Step 1. Capture

Lose your paper receipts! No more shoe boxes, no more messy drawers. Use the Foreceipt app to turn every paper receipt into digital data automatically. When capturing images of your receipts, you want nothing less than crystal clear quality. Foreceipt’s capturing screen includes a 3x9 grid that assists you with aligning the camera properly. All other data such as total amount, tax amount and vendor name will be automatically filled in. No more manual data entry. At this point, you can confidently throw out the paper receipts.

Right now many businesses transactions have switched to online due to the COVID-19 pandemic. You probably have many digital receipts in your email inbox. You can simply forward or upload these email and pdf receipts to Foreceipt, so everything is kept in one place. Read more about how it works on the Foreceipt website.

For the rest of your team and their expenses, we recently introduced Team Collaboration, where team members can now link their Foreceipt accounts to yours. Whatever they capture on their phones or submit on the web, it automatically syncs across the team and consolidates expenses under one view.

Step 2. Categorize

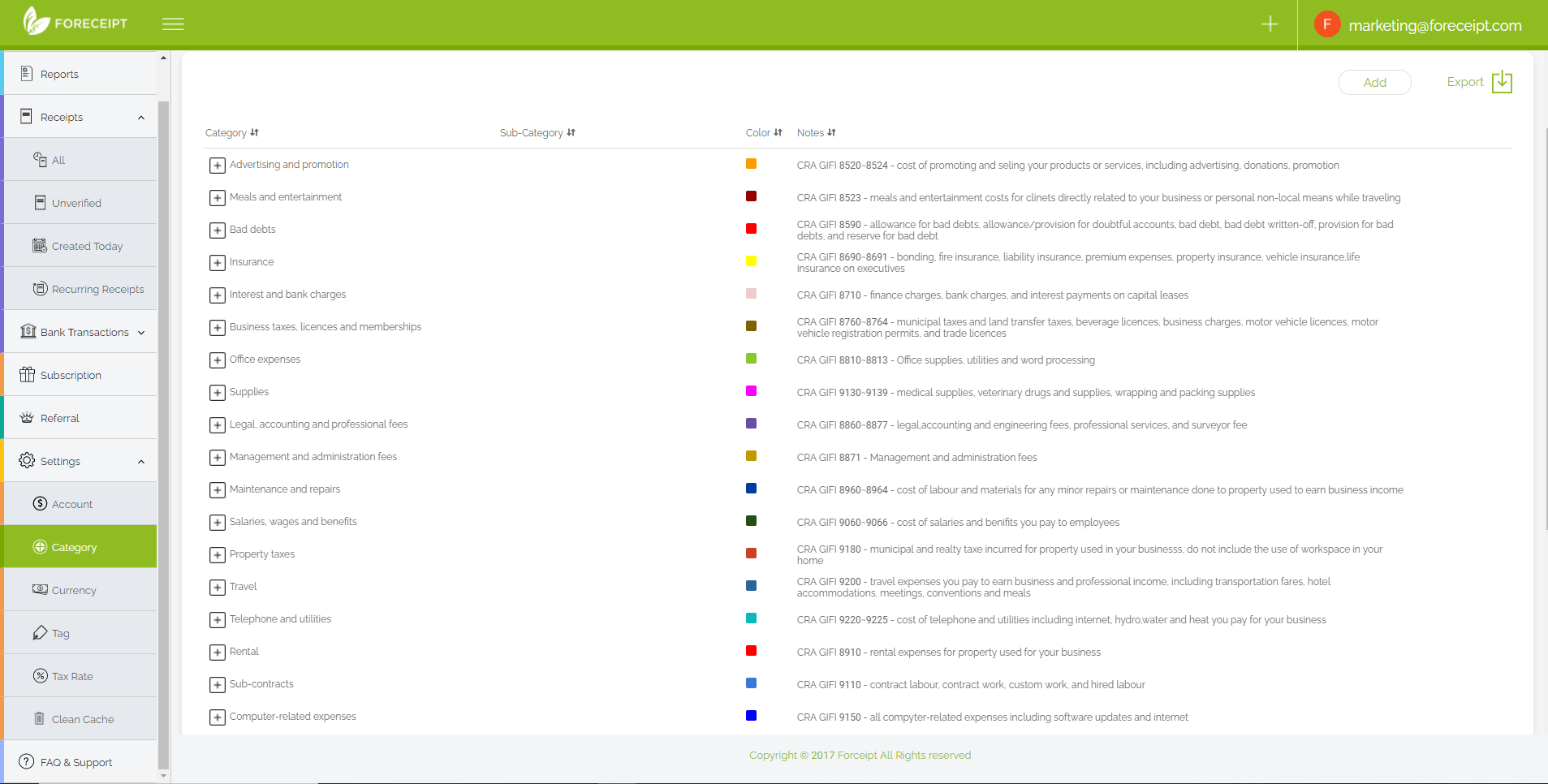

The Foreceipt app has an image recognition feature that helps you identify which expense category the scanned paper receipt belongs to. The tax bureau of each country or state has its own requirements for small businesses to categorize expenses. Foreceipt has already built in the CRA categories and IRS Categories in the app for users from these two countries. This is a supper handy feature to make categorization one click away. CRA example below. The key is to assign a category every time an expense occurs and your memory is clear. Don’t wait until the end of the year to do this because you won’t remember everything!

Step 3. Report

Your accountant will love you if you give him or her a nicely organized expense report in the tax season. Clear, itemized receipts will also be extremely helpful when your accountant reconciles your monthly statements. If you have been using any software like Foreceipt to track business expenses, this is the time of the year when your investment of time and money shows its value. If you used Foreceipt, you can simply generate a detailed expense report like below. All the images of your receipts will also be exported in PDF.

Watch videos on how to manage expenses here.

Tax management software

Now you have all your expenses organized, it’s time to file your taxes. If you don’t have an accountant, you can consider using tax management software to file tax digitally. These software ask you a series of questions to understand the nature and operations of your business. You will need the numbers in your expense report to tell the tax software how much your business has spent in each category.

Some of the most popular tax management software including the following:

TurboTax

“TurboTax Deluxe offers thorough explorations of tax forms and schedules and an outstanding user experience to new and returning taxpayers. Its tax interview and help system are both improved this year.”

TaxAct

“TaxAct competently supports online tax filing for new and experienced users. Its interface has improved since last year, but some of its old context-sensitive help is missing.”

TaxSlayer

“TaxSlayer Classic is an affordable tax preparation service that gets better every year. Returning users will find an improved user experience and comprehensive mobile apps, but not much context-sensitive help.”

All of these tools could work as a perfect companion with Foreceipt.

Checking for blindspots

Nobody runs a business perfectly. This article demonstrates some common mistakes you may be overlooking.

How to use your expense report

1. Establish a budget for each fiscal year

A budget works as a reference point to measure spendings in every aspect of your business, such as labour, rent, raw materials, marketing, legal and accounting. For example, when you cannot decide whether to invest in putting up some Google ads, your established marketing budget will give you a reference point of how much marketing budget you have used so far this fiscal year.

2. Measure your average monthly expenses

Spend the next 30 days measuring every single instance of spending related to your company. Every receipt, fee, utility, etc. After 30 days, you’ll have a good idea of your average monthly expenses. The key to this working out for you is to never stop keeping track, every single day, even after the initial 30 day period. The more you measure, the more you’ll be able to finely measure and refine where to spend more and where to spend less.

3. Paint a picture of your customers

When a customer makes a purchase, you can track the time of the transaction, which items they purchased, the tax subtotal and more. Within all of those customer receipts are patterns to be discovered. For example, there might be a high occurrence of one item being purchased with the other. This would open an opportunity to leverage this common pairing to your advantage through a sale or promotion.

4. Internal record keeping

Keeping track of your customer receipts is one part of the big picture, which is expense tracking. Customer receipts are essential for measuring long-term profits, so you can compare them to the expenses to determine whether you made a net profit or not.

Beyond expense management

Foreceipt’s Blog covers as much ground as possible to help out small business owners and freelancers. Expense management is about learning every day. If you’re managing your finances better than you were the day before on a consistent basis, growth is guaranteed.